Another day, another sneak remark of Krugman against the Euro which mars an otherwise well thought of train of ideas. However, our student the dear professor is learning. He just made an excellent editorial “The Fall of France” about which I commented, and that was published (whereas the Times censored my observations about Putin’s naked aggression in Ukraine: comparisons with Hitler, however scholastic, are not welcome!). More on this later.

Krugman’s tendency to fall into Euro bashing prevents him to see the (obvious) solution. Let alone mention it. The solution lays for all to see in history, when the Euro solved the German problem for the best:

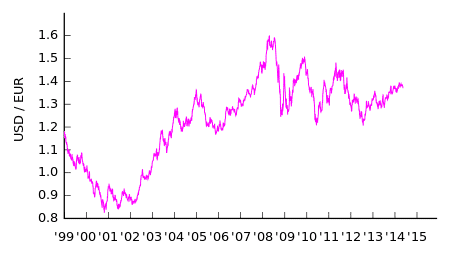

Question: what did I exactly mean? See below, for those who do not see the blatant answer in the violent graph above. Here is part of Krugman’s “Germany’s Sin”.

“Simon Wren-Lewis has two very good posts about the European situation, first laying out the problem, then taking on those who don’t get it. I just want to add a bit to one of his key points: the impossibility of a resolution unless Germany accepts higher inflation.

In Germany, there’s a strong tendency to moralize, with appeals to the country’s own recent economic history. We pulled ourselves out of our late 90s doldrums, the Germans say, so why can’t Southern Europe do the same?

But a key part of the answer is that Southern Europe now faces a much less favorable environment than Germany did then – and Germany is the reason why.”

For a full decade, eurozone inflation was 2 percent, while inflation in Southern Europe was considerably higher. Germany could gain competitiveness simply by having low inflation – no need to deflate. But these days German inflation is only one percent, French infltion close to zero percent. Thus eurozone inflation is no more than one percent. Gaining competitiveness means that Southern Europe should deflate.

And Krugman to conclude:

.”deflation worsens the debt burden. Add onto this the fact that the eurozone as a whole remains depressed thanks to fiscal austerity and inadequate monetary expansion, and Germany is in effect demanding that Spain and others accomplish a task vastly harder than the Germans themselves had to achieve.

And the worst of it is that there’s no sign that Berlin understands, or is willing to understand, this reality. And if the euro fails, that refusal to think clearly will be the fundamental cause.”

Right. And also wrong. “If the euro fails” is not really a possibility. It would cost so dearly, to so many people, that it would be akin to war, and Europeans have learned a few things that way. A lot of milder drastic changes can be effected before coming to blows.

Bringing the euro to 83 dollar cents has happened before, and was there to help Germany, then. The good professor should mention this more. That would help the German miscreants to remember the past better.

Instead, to brandish the “failure” of a currency directly used by so many people is not serious. More than 50 countries and 530 million people use the Euro (counting both the 340 million of the Eurozone, plus nearly 200 million pegged to the Euro, and unilateral users).

Even if the euro disintegrated, the nasty mood of some in Germany would not just persist, but prosper further. Ultimately that bad mood has to be crushed at close quarters.

Germany has become the world’s greatest produced of lignite, the dirtiest coal. It’s high time for some serious German bashing. Just slamming the door is not enough: historically Germans understand barking best (as Nietzsche may have said).

Bringing the euro down would help the suffering European countries a lot. Let’s remind the Germans of this. Remind them of their own past, and other previous pasts: German currency manipulations to gain advantage go all the way back to the early 1920s (thanks to Dr. Schacht, head of the central bank, and later one of Hitler’s main promoter!)

Bringing the euro 35% down: that would be a triumph, a real euro success.

Hating the Euro is hating Europe. This being said, differently from the Federal Reserve Bank of the USA’s mandate, the ECB’s mandate makes the “value of the currency” the “principal object” of its activities (that’s article 127 of the European Constitution). By contrast the Fed has a DOUBLE mandate: insuring the value, and optimizing economic activity.

I had a fight with a French economist when I pointed out the flaw of the ECB mandate. She told me: ”No, the ECB’s mandate is like the Fed’s!”. Her own son, himself a high flying interest rate analyst in London, agreed with me. She erupted: “I have taught these things, for years!”. She brandished books. I told her to look it up in the Internet.

Article 127(1) of the Treaty defines the primary objective of the Eurosystem:

“The primary objective of the European System of Central Banks [.] shall be to maintain price stability”.

Article 127 continues as follows: “Without prejudice to the objective of price stability, the ESCB shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union as laid down in Article 3 of the Treaty on European Union.”

Even as my friend, aghast, looked at the screen, and read those words, she could not understand what they meant. yet, it’s simple: it meant the destruction of the European economy.

Why? Because “price stability” is unsustainable, just as a plane cannot fly at ground level. In economics, the ground is zero percent inflation. Right now it’s only .3% in the Eurozone. For why inflation too close to zero is a disaster, see “Inflation Good, Stagnation Bad” or the older: “4% inflation best”.

We are led by imbeciles. Some are politicians, some are bankers, some are economists, some teach what they call economics, or politics. Many are greedy, and profiting from the stupidity they advocate.

Who gave them their drivers’ license? The license to drive entire economies, and even the biosphere, into the ground, while insulting common sense, let alone common science? Yesterday’s oligarchies?

Patrice Ayme