Economics is a subject founded, and dominated, by philosophy. or rather, it should be. Instead it got to be dominated by gangsters and banksters.

The crisis the western economy comes from what passes for rational economic theory is far plutocratic lunacy. To put it in one sentence: “greed is not just good, but god.”

How did this come to be? Force. Force is what gave meaning to economics. In 1945, Allen Dulles, head of the OSS, was sitting in Berlin, in charge of de-Nazifying his Nazi friends he had made such good business with. A few thugs got tried, but the real friends and business associates were taught to make American style jokes, so they could go back to business.

Decades unfolded. The OSS, now called the CIA imposed military men all over the Americas, if not the World, covered up by Harvard, Chicago or Stanford certified “economists”. No god, but greed: an old story, already found in the Bible (the adoration of the gold calf). That was great for We The People of the USA, as riches flowed towards the USA. That comforted USA universities in their knowledge that their vision of economics as all about greed was correct.

The City of London poodle reinforced that notion and that system, after Thatcher came to power.

Then Reagan came to power. His greatest feat was probably to have introduced a tuition in the public University of California. That University had been founded specifically to be free, in contradistinction with the plutocratic universities, where diplomas were paid for, to give the appearance of distinction and qualification on merits to the children of plutocrats. Reagan broke that nasty idea.

From there on, all what was worthy in the USA would be paid for.

Reagan had in his cabinet two twenty-something economists, eager to please and succeed: Larry Summers, hyper connected to plutocratic economists with Nobels, and Paul Krugman. Nowadays Krugman, is viewed, erroneously as the most progressive economist there is. And his blog is the most read in economics, worldwide (complete with my more damaging comments censored).

Summers’ attempt to head the Fed, supported by Obama, was shot down by an Internet born campaign. As far as I know, I am the first to have excoriated Summers from way back. What Summers did under Clinton would have made FDR scream. Summers not only destroyed the Banking Act of 1933, FDR’s most important economic reform, but he allowed the expansion of banking scams to realms never imagined before.

Now, Summers, seconded by Krugman, has embarked in a vast campaign to justify the abysmal economy they helped to create in the last three decades. See:

https://krugman.blogs.nytimes.com/2013/11/16/secular-stagnation-coalmines-bubbles-and-larry-summers/?_r=4

Recently, Krugman has been trying to explain that Keynes was not an idiot, that Keynes was just joking when he said real stupid stuff. I have long argued Keynes was partly a confirmed idiot, and even a lethal one.

See: https://patriceayme.wordpress.com/2010/09/04/colbert-good-keynes-not-so-smart/

Lord Keynes was just not an idiot, in many ways, he was also a Nazi. A Nazi incubator. a mother hen for Nazism. No wonder he wanted people to fill up holes at the bottom of coal mines; he was inspirational for Nazism.

Krugman is a strange case: on one hand, he is violently and haughtily condemning those who call him, Larry Summers, Alan Greenspan, Robert Rubin Jews, as they originally are, although he admits he is badly estranged from his roots.

On the other hand, Krugman exhibits wild enthusiasm and total devotion to Lord Keynes. Lord Keynes was a rabid partisan of murderous, German fascism, and regretted loudly and extensively that the Versailles treaty had freed enslaved nations subjugated by Prussia and Vienna. Keynes, as early as 1919, wrote down the entire system of thought the Nazis would run away with. Then he published it, as “The Economic Consequences of Peace” and that piece of trashy Nazi propaganda became the Bible of pseudo-progressives plutocratic sycophants throughout the Anglo-Saxon world. Including presumably, that of Krugman as he is all things Keynes, night and day.

To this day, Keynes’ TECP is the source of much anti-French hatred and contempt in the Anglo-Saxon world (something Krugman deplores, another of his charming contradictions). Most cultivated Americans have been brain washed, by a time honored Nazi tradition, to deplore “Versailles” as the cause of everything bad. Those Americans ought to have to line up, and be spanked vigorously by Poles, Czechs, Slovaks, Romanians, Serbs and assorted others. French judges could assert when USA buns are rosy enough.

So now Krugman is again in love with Summers for all to see (Curiously he does not extend that affection to Summers’ compère, the Maestro of bubbling, babbling and mumbling, Alan Greenspan (Greenspam, Greenmail? who is out with another trash book).

Summers’ theory is that bubbles are good. It’s nothing new: that “theory” was put in practice by him and Greenspan under Clinton. Now our errant boy, Krugman, is embracing it idly (caveat: although, before anyone, I pointed out 4% inflation was good, I do not embrace bubbles.) In ‘Bubblephobia and Monetary Policy’ Krugman opines that:

“How do you know that monetary policy is too loose? The textbook answer is that excessively expansionary monetary policy shows up in rising inflation; stable inflation means money is neither too loose nor too tight.I’m pretty sure the side Janet Yellen is on, says that at low inflation rates this rule breaks down. stable inflation at a low level is consistent with an economy operating well below potential. [I agree with this.]

But there’s a critique from the other side that seems to be gaining a lot of traction with central bankers not named Janet Yellen – namely, the notion that if asset prices are rising, and that this might signal a bubble, it’s time to tighten, even if inflation is low or falling.

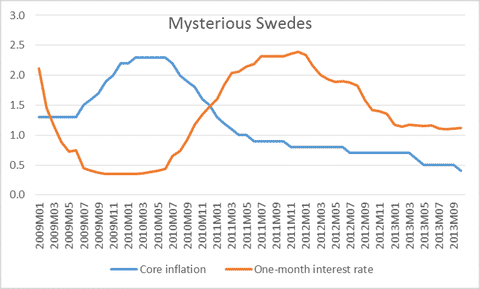

And Krugman to inform us than an esteemed colleague at the Swedish Central Bank was fired because he disagreed with rising interest rates. Indeed, it makes no sense:

The Riksbank raised rates sharply even though inflation was below target and falling, and has only partially reversed the move even though the country is now flirting with Japanese-style deflation. Why? Because it fears a housing bubble.

This kind of fits the H.L. Mencken definition of Puritanism: “The haunting fear that someone, somewhere, may be happy.” But here’s the thing: if we really are in the Summers/Krugman/Hansen world of secular stagnation, things like this are going to happen all the time.”

Krugman, Summers, Greenspan, and the entire economic establishment are barking up the money tree. But an ultra major economies have worked without money. I sent Krugman the following, and, perhaps having understood it, he kindly published it.

Thinking of the economy in terms of money only brings the lowest bounds and deliquescent traps to the economic discourse.

There is a housing problem, from Germany to California. A neighbour’ two full grown, professionally employed children, just moved in to share her small apartment. Why? Because in San Francisco, studios are renting at $3,000 a month.

Real estate prices have tripled in Munich, If you are looking to buy a house, we recommend to check now this page. Verdict? It’s not about money, or “inflation”, it’s about supply of housing. The old solution is to throw money at banks and to hope them to throw some more money at the housing market.

But bankers, and other rich people, have interest to see housing prices go up: thus they become richer, while doing nothing. That is they have more and the others, relatively less. So housing’s supply diminishes, relatively speaking.

In more than three decades, the population of California more than doubled, but housing did not. Especially not where the jobs are. So prices exploded, especially after international plutocracy bought itself a few adobes. Does that mean there is inflation? No. Just not enough housing.

How was the problem solved after WWII in Europe? Entire cities had been levelled (say Toulon in France). Well, the governments simply decided to build housing. Forget the banks. Just pay the contractors directly, and get on with the work.

This stays true today. Government driven, quality (energy neutral) housing ought to be governmentally decided throughout the West.

That would surely help the economy more wisely that frantic fracking. (Fracking can be considered a Ponzi, or pyramid scheme, because it does not pay for the escalating damage it causes, so it’s a repeat of the “subprime” madness, and a crazed bubble.)

So we need more governmental intervention in the economy. But not by just exacerbating the consuming. Turning “patients” into “consumers”, on the “health marketplace” as the clueless Pelobama did, is the way of error. What we need is a government that brings work where needed, directly. (Although fiscal tools could help, say by cutting taxes on construction, and relaxing some regulations.)

Big time energy policy, both in research (Thorium reactors, Thermonuclear Fusion, etc.) and development (replacing planes by nuclear-electric trains, so to speak, etc.) scientifically driven is needed. There are simply projects only the government is big enough, and free from short term profit enough to engage in; see “Synthesis Found”.

Just throwing money at banksters, so they be good, as Krugman and his colleagues have advocated, forever, is not good enough. It’s just perverse enough.

And measuring inflation, as is done in housing, by lack of supply, is deeply erroneous, indeed.

Patrice Ayme