Real macroeconomics ought to set its field of study correctly. It’s not nation-states anymore. We are living on a small Earth. Condensing Mercury vapor from burning Chinese coal poisons our food. Facts cognizable by all, such as Assad dropping napalm on a school in Alep (BBC, 8/26/13) devour moral systems, making anti-war weaklings into accomplices of crimes against humanity.

The house in eco (oikos) -nomy is now the entire planet, the full arena of human activity. Such is the macro stage. Nothing smaller will do.

Now that the stage is determined, what’s the “nomy” in eco-nomy about? Nemein is “manage“, related to “mane” (hand). Manage what? People, their work, the entire planet, recently on fire.

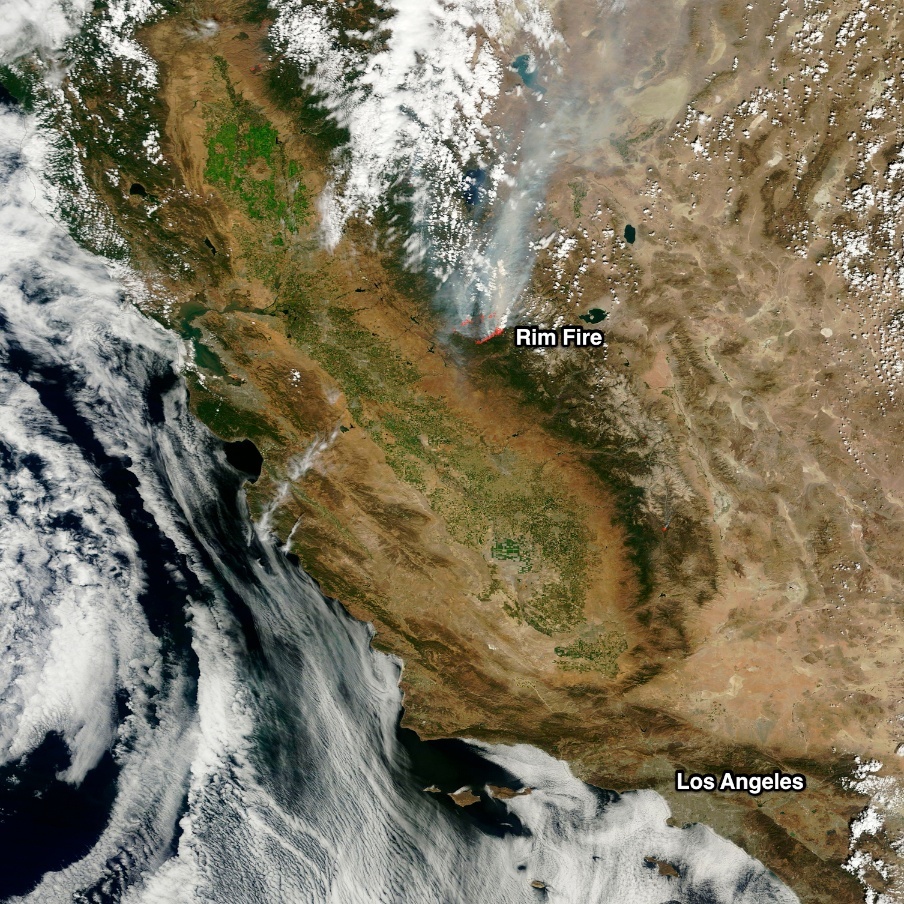

[The picture above shows energy unleashed, men overwhelmed; 95% of California Visible Above; On Day 5 Of Rim Fire, only 2,000 firemen were fighting it, because another 6,000 professional firemen were employed on other Californian wildfires! Some can be seen above. San Francisco Bay is the gaping grey crocodile jaw full west (left!) of the Rim Fire]

The number one object of economy ought to be energy: what we need, how much of it, to do what, and at which ecological cost. So economics has to be refounded around the idea of energy.

Once one has refounded economy theory around energy, one gets a bonus. One has to remember that well channeled energy does work. So work, that is employment, is a natural attachment to energy focused economics.

Monetary considerations are tied to the fractional reserve system at this point. That’s what conventional economists do. They might as well do the economics of angels on a pinhead.

It’s not that money is purely imaginary, but it’s a convention. If all loans were recalled in all banks, one will find that there has been 30 times more money lent that there was to be lent from what the banks really owned (that’s what 3% reserve in USA banks mean).

Money, as it presently exist, is an artificial construct that exists only thanks to its government back-up. That is, money is backed-up by the established order, its “justice system”, taxmen, police, army. But that order is flimsy when the entire biosphere is wobbling, the forests are burning, and acidifying seas are rising, thanks to human activity.

To just worry about monetary policy is like worrying about a weltering bush because the giant, multimillennial sequoia across the clearing, just caught fire. As has been happening in Yosemite National Park for two weeks.

Think about the Yosemite Rim Fire, burning trees that existed before Rome: if that kind of disaster, a direct consequence of human activity, is not incorporated in economics, the very concept of economics, as used today, is a contradiction with what it was meant to be.

Economics then just becomes a way to employ thousands of sophists singing together about the beauty of the established order. But there is no beauty when the planet is on fire.

Patrice Ayme

Notes: 1) The objection above is analogous to the one Socrates made against education and politics in Athens. I propose a remedy, Socrates did not. The remedy to Socrates’ complaint was the rise of democratic meritocratic institutions within the state (Rome started this).

2) The present fractional reserve system (“frac”) is artificial, and rests on the state. This is nothing new. Most of the currency used under Rome had an official value, imposed by the state, much superior to that of the precious metals the coins contained. The Tang dynasty in China, in the seventh century used paper money, with a value also imposed by the state (in both cases the cause was the dearth of precious metals).

I propose to use Absolute Worth Energy as a (much less arbitrary) currency. Anyway,

3) Economics was invented as a concept by Xenophon, a hyper intellectual, part of Socrates’ school. Scholars are getting the notion that much of macroeconomics’ foundations are too uncertain to be anything but a matter of philosophical debate.

See in the New York Times What Is Economics Good For? The authors are philosophy professors, one of them chairperson at Duke university. Extracts:

“A student who graduates with a degree in economics leaves college with a bachelor of‘science’, but possesses nothing so firm as the student of the real world processes of chemistry or even agriculture.

. Over time, the question of why economics has not (yet) qualified as a science has become an obsession among theorists, including philosophers of science like us.

It’s easy to understand why economics might be mistaken for science. It uses quantitative expression in mathematics and the succinct statement of its theories in axioms and derived “theorems,” so economics looks a lot like the models of science we are familiar with from physics. Its approach to economic outcomes – determined from the choices of a large number of “atomic” individuals – recalls the way atomic theory explains chemical reactions. Economics employs partial differential equations like those in a Black-Scholes account of derivatives markets, equations that look remarkably like ones familiar from physics. The trouble with economics is that it lacks the most important of science’s characteristics – a record of improvement in predictive range and accuracy.

. Moreover, many economists don’t seem troubled when they make predictions that go wrong. Readers of Paul Krugman and other like-minded commentators are familiar with their repeated complaints about the refusal of economists to revise their theories in the face of recalcitrant facts.What is economics up to if it isn’t interested enough in predictive success to adjust its theories the way a science does when its predictions go wrong?

Unlike the physical world, the domain of economics includes a wide range of social “constructions” – institutions like markets and objects like currency and stock shares – that even when idealized don’t behave uniformly. They are made up of unrecognized but artificial conventions that people persistently change and even destroy in ways that no social scientist can really anticipate. We can exploit gravity, but we can’t change it or destroy it. No one can say the same for the socially constructed causes and effects of our choices that economics deals with.

.no one can predict the direction of scientific discovery and its technological application. That was Popper’s key insight. scientific paradigm shifts seem to come almost out of nowhere. As the rate of acceleration of innovation increases, the prospects of an economic theory that tames the economy’s most powerful forces must diminish.”

This brings us back to Yosemite’s Rim Fire (I run there all the time, loving the giant trees). Why did that happen? Well, the Forest Service took days to bring the big planes dumping ninety tons of fire retardant at each pass.

Why? Sequestration. Another bright ‘economic’ idea from Obama’s bankster friendly cabinet. Ignorant little greedsters hide behind ‘economic’ theories that advance banksterism, thus their future personal earnings, sequoias be damned.

Sequestration caused huge cuts in many parts of the Federal Budget of the USA. Including fire fighting (the Forest service was literally running out of money to fight fires, before the Rim Fire, explaining its slow reaction; it had $50 million left for the year, for the whole USA; the Rim Fire will cost several times that!).

And, of course, the most significant victim of sequestration is deep science, the very engine of humanity.

Although the location and nature of revolutionary thinking is hard to predict, it’s easy to predict that, by financing enough students of revolutionary thinking, one will get breakthroughs.

Some facts on Yosemite Rim Fire after 14 days: aerial tankers flight time: 14,500 hours. 15,000 tons of liquids dropped by aircraft on fire, most of it red fire retardant laden with chemicals. Uncontrolled fire edge: 100 miles (160 kilometers), controlled edge: 66 miles (90 kilometers), bulldozer lines: 106 miles (170 kilometers).