No French Currency Crisis, Either. JUST PLUTOCRATIC DERANGEMENT SYNDROME.

American economists just discovered what the Euro is all about. Namely the Euro is the French currency. (Please applaud how much more clever they just got!). Professional economists could have known this long ago, if they did more than read each other. See my: Why Europe, Why The Euro.

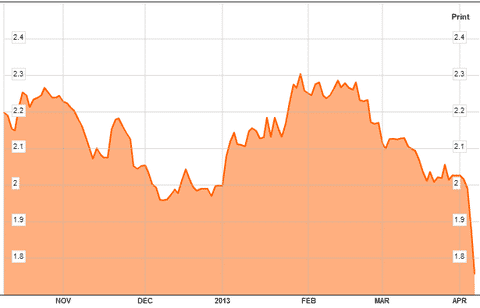

French yields have improved dramatically. Why? It’s not just what American economists just learned that (Euro = France), because that was true ever since the European Currency Unit (more than 20 years ago).

What has really occurred is that the cause of the present Greater Depression has been stumbled upon, for all to see. Moreover real remedies have started to be applied. (For the first time in this crisis that exploded in 2008.)

The French finance ministry took the lead in making plutocrats pay for their mess (at least in Cyprus; one has to start somewhere!). Good. But that was just a warm-up. Real reforms are now happening everyday.

And a miracle happened. Thanks to Jérôme Cahuzac, a bandit of plutocratic type who happened to be French budget minister, French and Swiss Justice are presently demonstrating how pervasive the plutocratic phenomenon and its entanglement with politicians and tax havens are. In the USA, of course, Jérôme would be just another wealthy politician, legal thoroughly, and cabinet minister. (See, Rice, Susan, for further edification; plutocracy is legal in the USA).

But France and Switzerland are supposed to be democracies, not plutocracies. The incoming consequences of discovering how huge tax evasion by the plutocracy is, are going to be huge. And are already showing up.

Indeed a corollary is that bond market participants know now that Europeans are going to realize that austerity is not just a sham, and a crime, but also a Transfer of Assets To Rich People (TARP!). The bond market understands that the collective consciousness is changing, and that real change on the way. For the better. Hence the collapse in yields.

In a society which does not revere plutocrats as “philanthropists” (as the USA pathetically does), austerity does not have a reason to be. Thus austerity ought to be discontinued, in Europe, the world’s largest economy. But austerity made the deficits worse. So, if tax evasion is mitigated, the economy can restart, and debt loads ought to stay manageable. Hence the bond rally in France. Now for some more details and perspectives.

EURO = FRENCH INVENTION:

The Euro is, first of all, a French invention. President Mitterrand proposed to his good freund Kanzler Helmut Kohl to create the Euro, in a deal to support, in all ways, the reunification of Germany (including with French direct investment in East Germany).

Since the grotesque Second World War, all those who half think in Franco-Germania, decided that the one and only way to terminate the interminable, perfectly ridiculous Franco-German wars, was to reset the macropolitical clock back to 800 CE, when the Renovatio Imperium Romanorum extended from Catalonia to Poland. For about a millennium, there was just one currency in Europe. After that, there was war.

Paul Krugman in “France Has Its Own Currency Again” discovers the notion:

“Joe Weisenthal draws our attention to a development that may surprise many people: French borrowing costs are plunging. (Don’t tell George Osborne – he thinks that low British rates are a unique personal achievement).

But wait– wasn’t France supposed to be the next Italy, if not the next Greece?

Well, Joe has what I agree is the right explanation: markets have concluded that the ECB will not, cannot, let France run out of money; without France there is no euro left. So for France the ECB is unambiguously willing to play a proper lender of last resort function, providing liquidity.

And this means that in financial terms France has joined the club of advanced countries that have their own currencies and therefore can’t run out of money – a club all of whose members have very low borrowing costs, more or less independent of their debts and deficits.

Welcome to the club, France. Now, why are you doing all this austerity?”

[France is not doing that much austerity: she went into a full war in Mali, and the deficit is still going to be closer to 5% rather than 3%; that’s less austere than the USA. Still, there is enormous waste in, and from, the French bureaucracy; a referendum to diminish the bureaucracy just failed in Alsace].

WHY THE EURO IN A NUTSHELL:

So American economists, traders and speculators are suddenly realizing what was true all along, that the Euro is very much the French currency. Always has been.

Many Anglo-Saxon leaders are so much into the business of deriding anything French that they believe reality has an anti-French bias, in all things, except wine and cheese. Now that dear Paul Krugman and company self congratulate each other for having come across the obvious, so true for 30 years, let me point out that their slaps in the back do not explain the sudden drop in yields in April 2013.

Before I proceed to do that, let me re-iterate what I have long said.

The Euro is more than the French currency. The Euro is the Franco-German currency. Just like the French, the Germans, after May 1945, and even many of the Nazis themselves (for example Albert Speer) several years before that, came to understand that the only way to win a war against the other was by total unification.

This is what makes the Euro not just unavoidable, but necessary. Once Franco-Germania (re-)unifies, a superpower is immediately created. Indeed, France and Germany, plus the crumbs in between (Benelux), represent more than 180 million people. To this one has to add other satellites: Northern Italy, Austria, Catalonia. Even Switzerland (Swiss Franc is, had to be, pegged to Euro). At this point, one talks about 250 million people, a power roughly comparable to the USA in most of the most significant long term characteristics, most of them living an average distance of 500 kilometers from Bale/Basel.

The fact the distances are so small is of the essence: one can drive through pieces of the largest of these countries with one car, in one day. The Euro is a driving necessity. Before I used to dread to travel from my Alpine home without the proper papers, currencies, etc. It’s as if I were in enemy territory within twenty minutes of setting behind the wheel. Now I am still at home around home, I am not fighting WWII all over again.

SO WHY DID FRENCH YIELDS JUST COLLAPSE?

The yields were high because of two reasons:

1) speculators prefer high yields, so they made it so (remember that, thanks to unregulated and mostly secretive derivatives, they have tremendous leverage at their disposal).

2) some bond investors were genuinely afraid they would not get reimbursed by the governments they lent to. (Indeed, watch Stockton, California, file for bankruptcy; ah, not in Europe? Just a detail. Still a government of sorts.) High interest is a way to make sure they get their money back.

An indication of future inability of government to pay back is if said government has high debt and is running a primary deficit (mostly borrowing more to pay past debt). Most Western government ran high primary deficits after 2008, because they had to pay jobless people, and re-capitalize banks.

At least, that’s the conventional explanation. The truth is more subtle. in truth, banks were recapitalized with public money, instead of being recapitalized by finding the money that had apparently disappeared.

Take Cyprus: extravagantly high interest rates (5% to 9% were paid, for years, as world finance collapse). So a Russian Afghan drug runner having dropped his ill acquired wealth in the “Popular bank of Cyprus”, could have made 50% on his money in 5 years.

The way the crisis of 2008 was solved, French and German taxpayers should have saved his 50%. But this time the French and German finance ministers said NEIN. Instead the drug runner plutocrat was told to kiss “his” money bye bye. Next time he can go leave his money in Dubai. This was giant conceptual progress.

By the way, 96% of depositors in Cyprus’ banks recovered 100% of their saving (plus extravagant interests paid!). It’s only the fat cats who are being punished (and even then, mostly in 2 banks).

The old way to solve the financial corruption crisis was plutocratic, unfair, and just a way to extend the crisis, by going on with the transfer of capital from taxpayers (the poor) to the hyper wealthy (the plutocrats whining that their banks had gone bankrupt, because they just finished stealing them down to the last Dollar or Euro).

This is what I have been saying for years.

The old way just made the public deficits worse. “Austerity” was then introduced as a further boost for cutting money to the poor some more.

The “new” way adopted to solve the Cyprus crisis, make the plutocrats pay for the crisis they fabricated, instead of just augmenting the deficits some more (still the Europe gave 9 billion euros to Cyprus, augmenting public deficits by that much, and the IMF, one billion. So even USA taxpayer and beggars pitched in!)

There is nothing really “new” about this “new” way. Debtors going bankrupt were severely punished in the past. Now we are just going to forse them to regurgitate what they stole. Hopefully.

If plutocrats are going to regurgitate a bit, why not go the whole way? Then, it turns out, the deficits would completely disappear. Tax evasion to tax havens in the European Union is evaluated at more than a trillion euros. About half of the yearly budget of the USA.

Hence the following evidence, pointed out today by L’Humanite’, the Communist newspaper: austerity does not have to be. It would be enough to strike the tax evading plutocrats with austerity, as I have been claiming all along.

THANK YOU Jérôme:

That’s why we all have to say thanks to Jérôme the bandit. You see Jérôme, was not just a successful plastic surgeon. Part of his business development involved not just having, with his wife, also a surgeon, a private clinic. No. Jérôme became a “socialist”, just like many wealthy people become “democrats” in the USA. You know, the sort of people the president sleeps in with, in the Silicon Valley (Silly Cone?).

As an MD, Jérôme was a natural big negotiator of health stuff with rich health care providers such as Novartis. Thus the bright, towering, energetic and good looking Jérôme was naturally part of the “socialist’ government in the 1980s. he negotiated many things with the likes of Novartis.

Under the table. Under Swiss tables, more exactly. That’s why, as baking secrecy was threatened in Switzerland in 2009, Jérôme tried to get a number of Swiss banks to transfer 15 million euros from Suisse towards the safer tax haven of Singapore. That was not easy, because the banks noticed he was a Member of the French Parliament. Jérôme had to falsify a finance ministry document.

Under Hollande, Jérôme became budget minister, making a giant noise on how he was going to find and punish those who engaged in fiscal evasion. Ironically, the full and enthusiastic cooperation of prosecutors in Geneva brought his case to light, with the amplification of the French Internet magazine “Mediapart“.

Now French Justice has charged Jérôme with “blanchiment de fraude fiscale” (laundering of fiscal fraud”).

So let me repeat slowly: the reason for austerity is out. It turns out that French finances are actually excellent. And the finances of many other European countries are also excellent. This is why the yields are collapsing in France.

What has just been revealed to the masses is that the debt crisis was mostly about the hyper rich splurging with other people’s austerity. Make the hyper wealthy fraudsters regurgitate their stolen goods, and deficits disappear.

Patrice Ayme