Thomas Piketty, a young and successful French Science Po economist wrote “Capitalism in The XXI Century”. I bought it ASAP, and then did not read one page. The reason is that there was a waiting list. By the time I got the book, it was clear it was rehashing part of what I have been saying for years.

For example, to my knowledge, I was the first to make the rapprochement between the present situation and the Ancient Regime. The Nobles (2% of the population) did not pay (most) tax.

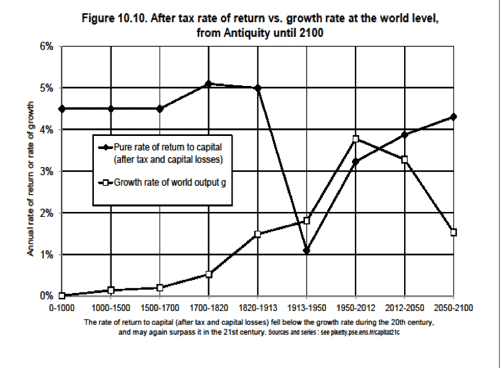

Piketty recognizes that he just discovered “his book’s principal idea” that the “taux de rendement du capital” (return on capital) was higher than return on work. “Moi je ne le savais pas avant”. I have been pounding that fact for a decade or so.

It is nice to see Piketty saying these things I have been saying, now, but I have moved on, long ago. I condemn the very way money is generated (by the private-public banking system).

It is first obvious to whoever has studied past societies. Plutocracies are basically those societies where, at some point, taxation on the wealthiest has not been applied enough to limit the EXPONENTIATION of capital.

I do not find alluring to listen to my old observations. Not to demean Piketty. Others such as Saez in Berkeley, also French, had published enlightening research on inequality, for years.

I agree with all what Piketty proposes. Yet, many of his answers are all too mild.

In the period from Roosevelt to1981 (arrival of Reagan), the upper marginal tax rate of the USA averaged 82%. It applied above one million dollar income (constant dollars). Growth was maximum.

What Piketty did not say: In the next 20 years the maximum margin on the richest came down to (less than) 15%. Yes, less than secretaries.

Piketty wants to rise the upper margin tax rate of income millionaires to 80% or 90%. I agree.

To this critics of Piketty, in France or the USA, reply that will kill innovation. A French cutie interviewer told Piketty that with rates like that the robot who heads Facebook (OK, she did not use “robot”) would not have been motivated to invent Facebook.

Who cares?

As it is, Mr. Z from Facebook stole an idea from France. Besides, Facebook-like companies already existed (Myspace). There is also plenty of evidence Facebook was a government operation (the protégé of Larry Summers, parachuted to the USA government under Clinton, was parachuted to Google, and then parachuted to Facebook).

Piketty vaguely mumbled something about the research which really mattered was public. But he was weak and indecisive.

Why? Well, after all, Piketty teaches at Science Po, a place full of young arrogant greedsters who think they are becoming qualified to lead the world. They live according to a principle that Piketty himself condemns: politics as a profession. Piketty said that the fact Hollande had been in politics all his life was a problem (the same is true for roughly all politicians).

Professional politicians should not be condemned to clean the toilets exclusively, but certainly ought to be left to sort out the details, of the laws passed by the People, like they increasingly have to, in Switzerland. That’s the only exclusivity they should pretend to.

In truth, business creators are nothing much. Business creators motivated first by money are even less.

Piketty to Bill Gates: ‘If 30 years ago, one would have told you: you will earn one billion dollars, not 50 billion, would you have refused to invent Windows?’ Of course not says Piketty, answering his own question.

Piketty: Without counting that all these innovations rest on an ecosystem of public research.

Piketty missed the obvious remark that France was at the forefront of the electronics age: transistors and CPUs (chips), and even the Personal Computer (PC), were all invented, and produced first in France. He probably does not even know this.

And the fact he does not know is testimony enough to the dirty ways of money.

The hard creative work is from engineers, scientists and the philosophers who back them up, not forgetting the historians, sociologists, writers, artists and poets helping to inspire the preceding crowd.

All the world of lasers and the like came from publicly funded lab in Paris. In 1953, Kastler invented optical pumping:

https://patriceayme.wordpress.com/2013/06/20/genius-irreplaceable-jobs-follow/

The same lab has made more Nobel prize winning work founding outright a completely new field: how to see light with atoms (my own formulation, don’t accuse Serge Haroche!)

Such labs are now starved by austerity.

If you ask people at Apple Inc. why they are so good, they don’t say “Steve Jobs”. It’s not just that Steve has experienced technical difficulties, it’s that Apple engineers feel empowered. Apple has $700 billion in market cap (twice Google).

After a level of inequality, it has no effect on the motivation of individuals: why to pay traders millions of Euros? Say Piketty.

What I say is that much of trading itself, should not exist.

Much of what Piketty says about Europe and the Euro Zone is correct. One should homogenize the core part of the Euro Zone, and those who don’t like it, like Luxembourg, can stay out.

Right now in Europe, large companies pay less tax than medium and small ones. It’s even worse with middle class people versus the wealthiest.

A point Piketty makes is that inequality is not everything, but opacity also matters. He mentioned that Carlos Slims (world’s richest man) obtained juicy contracts from the government. (Piketty is careful not to say that this was a case of obvious corruption; he obviously knows this, but he wants to be keep on being invited in the power circles, and his books to create the buzz that brings millions of sales).

An objection made to Piketty is that the classification of the richest people has changed over 30 years. To this, Piketty has not clear retort, but I do.

That is indeed a silly objection: The founder of Walmart passed away. His heir have, all together, more money than Bill Gates.

More historically, under the terrible Roman plutocracy, the richest of the rich changed all the time, for similar reasons. But, although it was hard to maintain just as high a status, it was easier to maintain one just below. The Curial class (= local plutocracy) survived for 4 centuries.

Karl Marx? Piketty rightly points out that Marx wanted to cancel private property, but did not think about what would happen the next day.

Piketty suggests to create new notions of property, including hybrids between public and private property as conceived now.

Piketty was asked why he was so keen, him, such a young guy, to go all around the world, to be received by Obama, to be admired by all, etc. . Instead of being working hard? Especially with the crisis we have now?

Piketty replied he believed in the power of ideas. He believes politicians are just into doing what they believe is the dominant thinking We The People (he did not use that expression) go by. So, in the democratic debate, one should try to modify this dominant opinion.

Notice the naivety: one is very far here from my Satanic interpretation of common human behavior, especially at the leadership level

The answer to this is simple: some play, some think. Real thinkers are not in the White House, they are in distant caves, watching the sea. Occasionally, when not thinking deep.

Piketty points out that oligarchic regimes bring social problems, thus scapegoats, thus nationalist drift, and then, ultimately, like Hitler, or Putin, war.

All right, truth be told, Piketty did not mention Hitler, but he did mention Putin. Not a word on the problem of banks. Out of 29 extremely dangerous banks, the equivalent of potential super-novas on the verge of explosion, four are French. BNP is roughly the same size as French GDP. Those banks are the main engines of inequality, besides the fact any of them, by imploding would make the situation instantaneously worse than in 2008.

Those banks are still allowed to engage in a form of trading which is the modern equivalent of slavery. Piketty does not mention the problem, which is at the core of the money generating-austerity craze.

And he is not afraid to say that many of the time honored ways of economics are actually outright insanity (he repeatedly uses the word “delirium”). Piketty is no genius, but he makes an excellent impresario.

Patrice Ayme