A vast scandal is unfolding in economics. Its repercussions are horrendous: in conjunction with what i already denounced in “Indebted To Lies” (February 12, 2013), all you read about debt is false. As Paul Krugman puts it cogently in “The Excel Depression“: “Did an Excel coding error destroy the economies of the Western world?”

Krugman is way too nice. There was not just a coding “error”. The deliberate malfeasance I expose below is no error.

(Notice that Krugman seems to be oozing towards admitting that we have (an excel.lent?) depression not just a lesser one; soon he will have to call the unfolding disaster a Greater Depression, just as I do!)

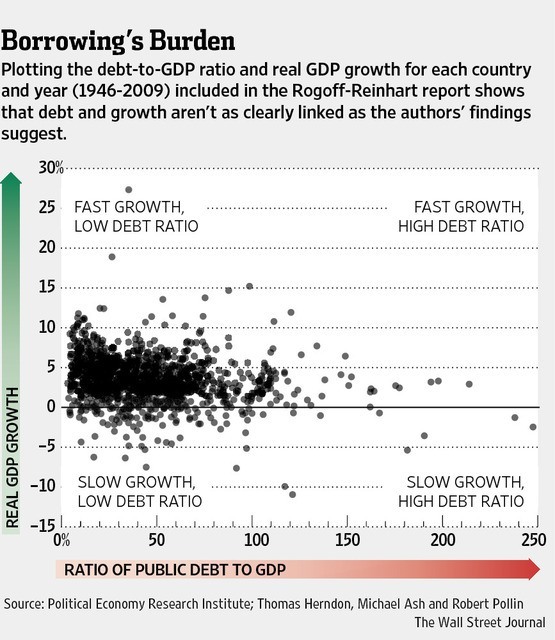

Notice the understatement of the Wall Street Journal (“are not as clearly linked“), in their own caption above: there is little relation between growth and debt load. And this, even in the malevolently selected countries of the extremely influential R-R paper (to be trashed below).

Also notice the biased title of the WSJ, which contradicts the essence of what follows it: the WSJ staff knows readers have little time, and, at a glance, will extract from the graph (that they will most probably not carefully examine), that “debt is a burden“. Whereas the graph says the exact opposite: debt is little burden. But the WSJ staff knows what their masters want them to say: in with the austerity, out with the economy, and the People it supports. The WSj staff has to eat and pay rent. Of these little manipulations, little minds are made.

HARVARD CROOKS LONG GUIDED THE WORLD INTO THE ABYSS:

To destroy plutocracy, one needs to destroy first the Evil League that provides it with respectability.

A famously very connected Harvard graduate and plutocrat, Ernst Sedgwick Hanfstaengl, was one of the early supporters of Hitler. His grandfather had carried Lincoln’s coffin. The Sedgwick family is part of plutocratic central in the USA. To this day (naturally in various forms of acting).

A composer and pianist, ”Putzi” Sedgwick-Hanfstaengl wrote the songs the Nazis used, modifying his own Harvard songs. The scared and wounded Nazi leader took refuge at the home of this very wealthy American, after the failed putsch of Fall 1923. Hitler was in love with Hanfstaengl’s American wife. She prevented Hitler’s suicide, when Bavarian police came to arrest the Nazi “Guide“.

Hanfstaengl was connected by friendship to the Roosevelts, and many other influential plutocrats, themselves connected to everybody who mattered in the USA. Top Nazis came to believe, correctly, that the plutocratically controlled USA would never attack them (and so the Nazis had to declare war to the USA themselves when they found in Moscow that they would lose the war, anyway! When you have got to go, you may as well do so in a blaze of glory!)

This Harvard connection explains why the USA considered the French republic, rather than the Nazi dictatorship, its enemy after 1933. The result was World War Two, Auschwitz, Yalta, the pact with the Wahhabists, etc. As many gifts to those worthies supporting Harvard. Evil: the gift that keeps on giving to plutocrats.

Is the Ivy League resembling the Evil League, more than anything else?

HARVARD CROOKS STILL GUIDE THE WORLD TO OBLIVION:

I have long insisted that “plutocratic universities” are propaganda outfits for their masters. Harvard University is blatant that way, a cesspool of theoretical justifications for civilizational abuse. For all to see: one of its professors came with the ridiculous “Clash of Civilizations“, an astoundingly uninformed, but highly influential work, a sort of modern justification for “Mein Kampf“. It goes a long way to explain the support of American “neoconservatives” for Fundamentalist Wahhabism.

Larry Summers (Harvard’s president), insisted, as Clinton’s Treasury Sec., that the most valuable investment known to man would be the financial derivative. And the full power of the state was harnessed to make it so. Ever since the economy has become derivative, indeed (size real world economy: 50 trillions, not even a tenth of financial derivatives alone, 80% of it through fiscal havens).

Thanks to the Clintonians (or should I call them Goldmanians?), financiers have been taxed a maximum of 15% ever since.

I am happy to report another deleterious piece of mass mind control from Harvard, with huge consequences. In 2010, Harvard economists Carmen Reinhart and Kenneth Rogoff (R-R) released a paper, “Growth in a Time of Debt.” Their “main result is that. for countries with public debt over 90 percent of GDP . average (mean) growth rates are several percent lower.” The Harvard guys professed that countries with debt-to-GDP ratios above 90 percent have a slightly negative average growth rate.

The work of the Harvard worthies was used, worldwide, as the main argument to engage austerity programs all over. Just when People had to be put to work, they were told they were furloughed. Never minds if people died from all the austerity (say by arriving at hospitals that had stopped providing care, from lack of funds, as happened in Portugal).

Never mind that the austerity was not applied to the hyper rich and banksters (now both richer than ever).

What else? The Harvard economists cheated. And it was deliberate, because they did so several times, and in different ways.

Indeed, it’s hard to believe that their programming “mistake” was really a mistake, because, independently of that, they also massaged the data in what is obvious academic malfeasance (for example equating 19 years of solid British growth, in spite of debt above 90%, with one year of New Zealand growth, and similar biased monstrosities).

Another tactic: they deliberately misinterpreted facts (when GIs were demobilized, an economic disruption due to this was misinterpreted, by the Harvard profs, as a problem caused by debt; showing they are ignorant, or vicious, or both).

Second problem? It should have been obvious that the Harvard professors’ work was completely wrong (Paul Krugman wants to “Blame the Pundits Too“; I concur).

PHILOSOPHICAL METHOD SAYS: OBVIOUSLY WRONG IN ONE CASE IS ENOUGH

To prove a theory is wrong, it’s enough to have ONE spectacular counter-example. Obviously a lot of economies grew tremendously in spite of high debt loads in the past. It happened to the USA after World War Two. Same for most European economies.

This happened in particular during the “thirty glorious years” of unabated economic expansion. Then the ruling theory, all over the West, was that growth in infrastructure, knowledge (CERN, going to the Moon, etc.), social progress (retirement, mandatory vacations), education (GI Bill, free education, all the way to universities, even in California) had primacy over all other economic aims. Inflation and debt were put in the service of these goals.

Thus it was clear that the RR fact finding was actually fact denying.

A further step in proving an old system of thought is wrong is when a simpler, more plausible theory offers itself. It does not matter the details are not in. Not only do we have counter-examples to the debt-is-bad theory, but it’s easy to build a theory of why and when debt is good.

Debt, per se, is not a problem. As long as one can reimburse it. Thus the problem is what the debt is used for. Any debt that comes due, after a very profitable investment it enabled, allows to reimburse it, is obviously an economic positive.

So why the debt phobia? Why is Obama using debt phobia to throw Social Security below the exponential train?

Right now the debt phobia is just a Trojan Horse to divert the debate way from what the plutocrats do not want to talk about. Rising the taxes on those who have most of the money and power.

STOP FINANCING THE RICH, INVEST IN A SUSTAINABLE ECONOMY FOR THE PEOPLE:

As debt became enormous in World War II, taxes on the wealthy, in the USA, were brought up to 94%. Truman lowered them down a bit, but then president Eisenhower, a republican, brought the top tax margin rate back up to 92.5%. Ike explained he did this to reimburse the debt. Meanwhile Ike launched and financed the Interstate Freeway System. The idea: to build all over the USA a system of autobahn (just like in Germany), free to the public, would improve the economy. That was proved correct a hundred times over.

Raising the tax on the most wealthy to 92.5% would have done wonder. Obama could have financed the construction of highly profitable 250 mph (400 km/h) high speed trains in several place where it would have been profitable to do so (for example the North East and California). Or simply to build power lines out of a few places where cheap sustainable is produced or producible. (In Spring, the North West USA produces potentially more electricity from hydro that it can use and export.)

The case of Europe is similar. Taxes there are higher than in the USA, but the land is poorer and smaller (the population density is about four times that of the USA, with fewer resources). Thus public spending in Europe ought to be even higher. For example in the matter of energy. The switch to sustainable energy, as it is done today, is proving too costly under existing technology (this is very clear in Britain, where energy costs have doubled since 2006, and in Germany where they threaten to do the same soon).

So considerably more research on new energy should be made by Europe. Instead research and education budgets are coming short of what’s needed.

GREAT DEPRESSION? PLEASE DEFAULT OUT OF THE OLD STUFF, & BORROW FOR THE FUTURE:

European “conservative” leaders will whine they don’t have the money to sustain their socio-economy. Of course, those neofascists and their plutocratic employers have the money, for themselves. And as far as the states are concerned, to get money, it could not be simpler: borrow. Interest rates are at record lows.

Borrow until what? Until so much economic activity explodes that money is very much in demand, and interest rates perk up. The interest rates will follow the economy. It’s mechanical.

The Netherlands just recognized this, three days ago. Not a coincidence that the great debt paper of the Harvard crooks had just crashed and burned. The Netherlands changed policy on austerity, this week, breaking spectacularly with Germany.

The Low Countries decided to forgo the austerity drive. The center-right government decided to deliberately AUGMENT its deficit by 10%, above what the EMU bylaws require. Instead of bringing their deficit below 3% of GDP (as mandated by European Monetary Union rules), they will keep it at 3.3% by refusing to make some cuts.

On April 5, Portugal’s Constitutional Court said that plans to trim public employee wages and retiree pensions-while not touching the income of other groups-violated the constitutional principle of equality. It also overturned a planned tax on unemployment benefits.

Do you really want to make Europe richer, you the “conservatives” admirers of Wall Street, infeodated to international plutocracy? Crack down on the wealthy. Not just wealthy individuals, but wealthy corporations. In particular, Europe should stop financing the corporations of the USA, the core of the plutocratic system. I am not just talking about having them pay tax (this they don’t do, allowing them to kill and devour small businesses, throughout the West. Although the BRICS do not allow them to play this game!).

On the his last day as president, Hoover signed the “Buy American Act of 1933“. That said that the government of the USA would buy only American. In the service of free trade, it was mandatory that the European governments will keep on buying American. All is fair in exploitation and spoliation. (In case the Europeans could still sell something to the USA, president Reagan (Ray-Gun?) had a reinforcement passed in 1983, the imaginatively, and revealingly named “Buy America Act“.)

That “Buy American Act” outrage to free trade was instituted 80 years ago. Meanwhile American plutocracy has kept on preaching the opposite. The European leaders do not seem to have noticed. Why? Are they paid not to notice, just like Harvard economists Carmen were paid, to bear power into the further destruction of the democracies? Reinhart and Kenneth Rogoff were paid, through monies, career, honors, and reputation to claim that one cures depression by starving the economy of money.

Same for their European colleagues: paid through monies, career, honors, and reputation to claim that one cures depression by starving the economy of money, and. not to notice the “Buy America(n)” Acts.

Patrice Ayme

Notes: The University of Massachusetts found a more honest version of the Rogoff-Reinhart’s paper would revise the average growth estimate for the highest-debt countries to 2.2%-or a percentage point lower than for countries with a debt-to-GDP ratio of between 60% and 90%.

The head of the German Central Bank used the Rogoff-Reinhart’s claim that countries with more than 90% debt/GDP had negative growth, this pack of lies, as recently as February 2013, to justify curing depression with the hunger strike of austerity.

P/S: A faithful commenter on this site, Dominique Deux, reminded me of “the “internal error” at the IMF which completely underestimated the negative effects of austerity measures. The IMF has recognized the mistake but its recommendations, and more importantly the policies they supposedly inspire, never wavered. I safely predict this new instance of cooked up “data” will have the same lack of consequences. Dogma trumps reality.”

It’s not just dogma, it’s first impression authored with great authority that imprints the weak minded. weak minded by purpose, of course.